Why do we ask for ID and proof of address?

We know it can feel frustrating to be asked for photo ID or proof of address — especially if you’ve been a member with us for years. We get it.

So, here’s why we must ask, what we need, and how it protects both you and your Credit Union.

It’s not us being awkward… It’s the law

All Credit Unions in Ireland must follow Anti-Money Laundering and Counter Terrorist Financing (AML/CFT) legislation under the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010–2021, as overseen by the Central Bank of Ireland.

In simple terms, we are legally required to:

- Verify who our members are

- Keep up-to-date photo ID and proof of address on file

- Recheck documents from time to time — even for long-standing members

These rules exist to prevent fraud, identity theft, and financial crime, and are in line with Anti-Money Laundering Ireland regulations.

We must be able to show that our records meet legal standards. Failure to comply can result in enforcement action, including fines and public reprimands. In serious cases, stronger regulatory action may apply.

So, when we ask for ID or proof of address, it’s about keeping Croí Laighean Credit Union compliant, trusted, and secure for the long term.

“But you know me!”

You’re absolutely right — and we love that local, personal connection.

Years ago, knowing someone personally might have been enough. Unfortunately, current regulations no longer allow that. Even if you’ve been a member for decades, we must still hold valid, current documents on file.

If we don’t have up-to-date documents, we may:

- Ask for ID when you visit the branch

- Be unable to process a loan or certain transactions

- Pause account activity until documents are updated

We don’t enjoy doing that, but we are required to by law.

What documents do we need?

Photo ID – Your photo ID is valid until its expiry date. We accept:

- Current passport or passport card

- Current driving licence (Learner Permits are acceptable)

Please ensure the document has not expired, and if using a passport, the passport is signed

Proof of address – Your proof of address is valid for 5 years from the date we receive it.

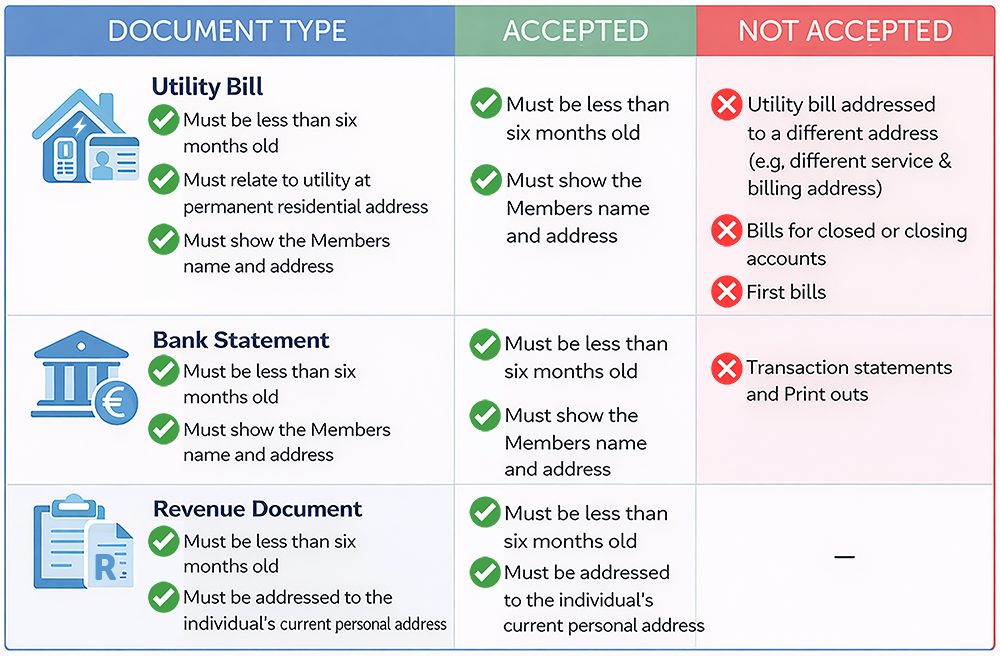

We’ve included a detailed table below outlining what types of proof of address we accept and what we cannot accept (Utility Bills, Bank Statements, Revenue Documents).

PPS Number – why we sometimes need proof

When issuing a loan, we are legally required to collect and verify your PPS Number.

We also request it when opening accounts under the Return of Payments (Banks, Building Societies, Credit Unions and Savings Banks) Regulations 2008. Financial institutions must make reasonable efforts to obtain PPSN details due to reporting obligations to Revenue on dividends and interest paid.

We also require PPSN for fixed-term deposit accounts.

Please note:

- We accept official documents that clearly show your name and PPS Number

- We cannot accept a PPSN card as proof. Unfortunately, Banks and Financial Bodies are not defined as “specified bodies” under the Social Welfare Consolidation Act 2005 and cannot legally accept the Public Services Card.

Why all of this actually protects you

These checks aren’t just box‑ticking exercises. They help to:

- Protect members from fraud and identity theft

- Prevent financial crime

- Keep your Credit Union secure and trusted

- Ensure we remain fully compliant with Central Bank regulations

And because we’re regulated by the Central Bank of Ireland, we don’t have the option to opt out.

The bottom line

- We may need to ask for ID — even if we know you well

- We must hold a valid, current ID and proof of address

- PPS Number verification is required in certain situations

- These rules come from national legislation and the Central Bank

If you’re ever unsure about what’s needed, just ask. We’re always happy to help and keep things moving smoothly.

Thanks for your understanding and for being part of Croí Laighean Credit Union.

Join Us

Join Us